We are often asked for a Credit Karma review. Well here you go!

CreditKarma.com relies heavily on TransUnion data. So by going through them, you get the same credit scores that TransUnion sells directly to consumers. They also provide a nice report card that grades your credit from A to F across seven key components affecting your scores. It then ranks the importance of each factor on a scale of high, medium or low. Users can also play around with a credit-simulator tool to see how your scores might change if you were to apply for a new credit card with a $10,000 credit limit, or if your home was foreclosed. The site allows you to check your score every day.

Credit Karma Review – The Process

What is nice is that they don’t require too much info from you to sign up. They provide real-time access to your credit. Since the alternative is waiting for up to a year to find out about mistakes, this is light years ahead. I’ve signed up about 8 months ago and I check in from time to time. It’s great to be able to check on it whenever you want to make sure it’s moving in the right direction, and it seems pretty secure to me.

Options:

They not only give you a “mock” score, they will also show you what is impacting your score, and ways to improve it. Here’s are some of the components:

- Open Credit Card Utilization

- Percent of On-Time Payments

- Average Age of Open Credit Lines

- Hard Credit Inquiries

- Debt to Income Ratio

There are lots of other metrics on there, but these are a good snapshot of what’s impacting your credit score.

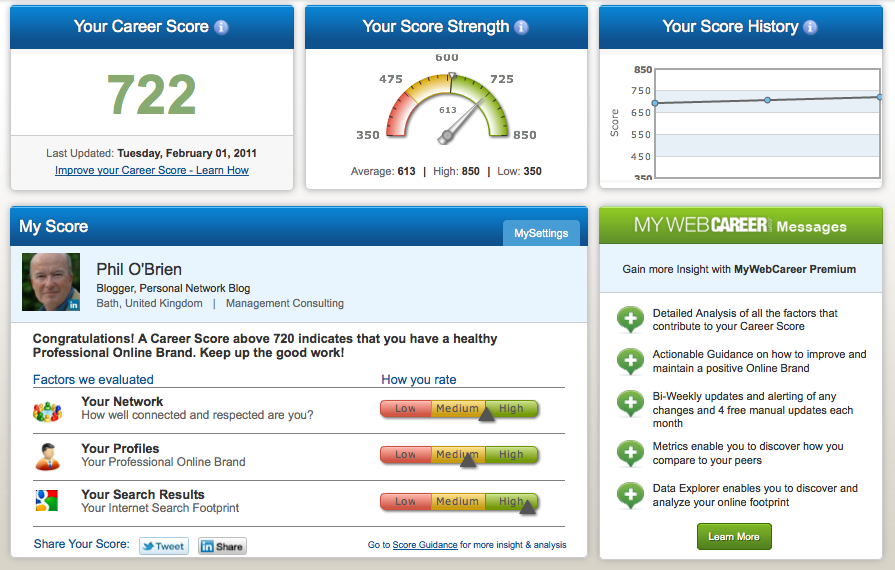

The Credit Karma Review – Their Awesome Dashboard

They have a cool little tool that lets you lay out a credit improvement strategy, and then they’ll tell you how much your score will change. I’d recommend it to anyone who wants to target the easiest ways to bump up their score.

Any Downside?

Credit Karma is legitimate, but it might not be 100% accurate. Since it is a free credit score, there isnt really a downside in signing up. In fact, it might just teach you a thing or two about your credit, and how to change it going forward.

If you don’t want to pay for a credit score and you can live with a rough estimate, then Credit Karma is okay. There are only free credit estimation sites like Credit Karma or Quizzle. Actual credit scores like FICO are never free. Don’t be tricked by any site offering a free credit score as long as you sign up for their credit monitoring.

Credit Karma is a legit site HOWEVER it is only an estimation service. It should never be used for serious purposes like buying a home or car. In this case only the FICO score will do and it’s not free: you can buy it for $20 at myfico.com.